Gamble Kid Bloomers position Position On line For real Money otherwise Totally free Subscribe Today

Content

- Iphone mobile casino games – What’s the Come back to User (RTP) rate of Kid Bloomers?

- Great Riches Transfer: How Boomers Is Passageway on the Luck on their Heirs

- How is Baby boomers Discussing Their health?

- Ramit Sethi: 16 Passive Earnings Top Performances Making Additional money inside 2024

- Ideas on how to Play

It’s simply natural you to definitely Gen X general create own far more money than just Gen Z. Before we look for the reasons behind the current generational wealth gap, it should be clarified you to certain difference in wide range height anywhere between a couple generations is normal and to be likely. “That is more difficult for folks who have physical work and lower job experience, however, we feel the majority of people can perhaps work more than they do now,” Eschtruth told you. To build as often — or even more — money since the boomers, younger years would need to make the most of compounding interest. However, along the second decade so it intergenerational transfer will make millennials “the brand new wealthiest age bracket of them all,” depending on the annual Riches Declaration from the around the world a property consultancy Knight Frank. Although not, 55% away from middle-agers which decide to say goodbye to an genetics told you they’re going to pass on below $250,000, Alliant discovered.

Iphone mobile casino games – What’s the Come back to User (RTP) rate of Kid Bloomers?

Overall, Child Bloomers is fantastic for players who take pleasure in charming layouts and simple gameplay, however it may not suit those people searching for huge winnings or far more vibrant have. Of many Seniors are at a stage with the household in which he could be thinking about transferring wealth to another generation. Everything own has basic matter objects in addition to such things as features, money otherwise later years profile, stocks and you will bonds, artwork, accessories, stamp or coin selections, etc., Mazzarella said. Professionals define exactly how boomers can be dictate where they slip anywhere between bad, middle class, upper middle class and you can steeped.

Great Riches Transfer: How Boomers Is Passageway on the Luck on their Heirs

- Being a good notary signing broker, you must earliest end up being an excellent notary.

- “Cellular banking app enable it to be so simple to track where you stand getting your currency,” says Sonali Divilek, head from digital avenues and you can something on the Realize.

- Not only are they among the best-creating some thing while in the winter months and you may previous, but with suitable structure, they are able to machine and get the most used gowns portion to suit your audience.

- Millennials ought to be thinking about setting up a home plan.

Previous accounts tell you an evergrowing disconnect anywhere between just how much another age bracket needs for from the “higher wealth import” and how much the aging moms and dads thinking about making him or her. Of these currently retired, Societal Security indeed helps complement its income, however the average benefit is simply $step one,691.53 per iphone mobile casino games month. For this reason, of numerous resigned boomers might need to tighten the spending an excellent portion to ensure they could remain lifestyle easily through the retirement. Kiyosaki, a staunch a property buyer who famously possess 15,one hundred thousand characteristics, is becoming urging Boomers to market their houses. “Basically were a child away from a BOOMER … I would nudge my personal parents to market their home, stocks and securities today … when you’re prices are higher … through to the Crash which is future,” the guy wrote within his latest article.

How is Baby boomers Discussing Their health?

- Nevertheless the social will not master the newest magnitude of your own state, told you Jack L. VanDerhei, look movie director in the Worker Work with Search Institute.

- The newest high-investing symbols are created while the a rabbit, a little sheep, and you can a duck.

- Government specialists speak with enterprises to improve different factors from an excellent team, along with productivity, government and you will visualize.

- The good news is, there are tons of cashback looking applications you could apply out of.

- Certainly one of child boomer homes which have later years deals, the fresh Transamerica Cardio to have Senior years Education rates their average really worth in the $289,100000.

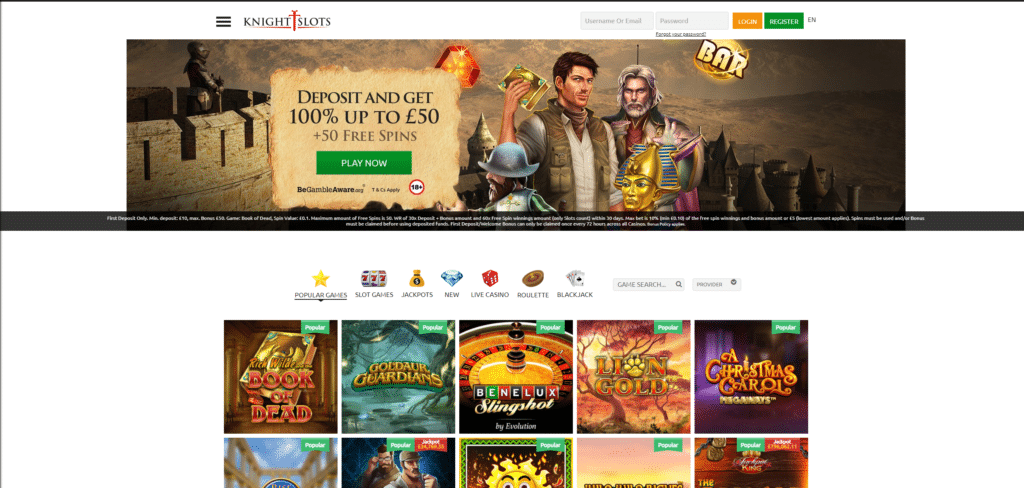

Welcome to the brand new enchanting arena of Baby Bloomers by Booming Games, in which lovable farmyard dogs spring season alive inside a captivating bust from color and fun. So it on the web position games grabs minds featuring its lively image and you can a countryside melody you to instantly kits a great lighthearted temper. Money and you may prosper on the good Kiplinger’s suggestions about paying, taxes, later years, individual finance and. Undertaking a lasting wealth government plan feels as though undertaking a good sounds playlist — it’s extremely personal and will contain a variety of templates. In a number of portion, somebody disregard to include in their assets things like dated pensions, old 401(k)s out of prior work, genetics, Dvds, annuities and you will local rental money out of investment features.

Ramit Sethi: 16 Passive Earnings Top Performances Making Additional money inside 2024

Financially speaking, millennials have not got most of some slack plus the closure of the wide range pit are subsequent put off. “Probably the just great I’ll have in this entire dialogue,” VanDerhei told you, is the fact a 2006 congressional work provided businesses power so you can instantly enter group in the 401(k)s. One to gets more individuals to store, nevertheless primarily advantages young pros that have decades to accumulate bucks and you can development. The brand new Federal Institute for the Senior years Security (NIRS) computes one a couple of-thirds from households years have deals equal to less than its yearly income. “If i needed to retire I would be bankrupt pretty soon. I’m able to probably survive 6 months to annually.”

Ideas on how to Play

“If you have an exact-work with plan that’s encouraging you $fifty,100000 a year, you’ll be getting one within the monthly premiums on the rest of your daily life,” VanDerhei said. “A 401(k) package offers a lump sum at the 65, and there is little stopping you from blowing in that very easily.” “They haven’t seen their more mature locals not having enough currency yet ,,” VanDerhei told you. “It may need years’ worth of reports for the nights reports, proving the newest predicament of these retired people not having enough money.” To that part, 68%, away from millennials and you will Gen Zers have obtained or be prepared to discovered an inheritance away from almost $320,one hundred thousand, on average, United states Today Strategy receive. Concurrently, 52% of millennials imagine it’ll rating more — no less than $350,100 — according to another questionnaire from the Alliant Credit Relationship.

To go on track regarding target, Fidelity says people must have set aside 5 times its income from the years 55. With for example a large disparity inside wealth, it might seem unlikely one almost every other years will ever catch up to help you Boomers. But something you should recall is the fact that younger generations feel the electricity of time and you will compounding attention to their front side. At the same time, feedback out of passed on riches are switching, centered on BlackRock’s Koehler. Moms and dads want to be positive that the next generation is going to get the same well worth system as much as building wealth. The main difference is simply because “mothers are merely not connecting well using their mature people on the economic information,” told you Isabel Barrow, manager from financial believed from the Edelman Monetary Engines.

(0)